Today’s global web outage has brought card payments to a standstill, affecting retailers, theatres, and visitor attractions. The disruption underscores the vulnerability of our increasingly cashless society. Retailers, in particular, faced significant challenges, with many forced to revert to cash-only transactions, leading to long queues at ATMs and disgruntled customers.

To mitigate the impact of such outages in the future, supermarkets must consider implementing reliable backup solutions. One effective strategy is the immediate deployment of 4G/5G SIM card-based standalone card devices. These devices can operate independently of the primary network, ensuring continuous card payment capabilities even during internet disruptions.

These standalone card devices use cellular networks (4G/5G) rather than the store’s internet connection, reducing the risk of complete payment system failure. They are easy to set up and can be quickly deployed across multiple locations. By maintaining card payment capabilities, supermarkets can avoid losing customers to rivals during outages.

To ensure seamless operation during outages, retailers should work with their till software providers to create a manual entry button for emergency standalone devices. This feature will allow cashiers to record transactions processed through the backup system, ensuring accurate reconciliation and reporting.

While the lack of till integration and the need for manual cashier entry may introduce room for human error, the benefits outweigh the potential drawbacks. Maintaining the ability to process card payments during network outages will help supermarkets retain customer trust and prevent revenue loss.

Retailers should immediately seek consultations with their relationship managers to discuss the deployment of 4G/5G SIM card-based GPRS standalone card devices. Collaborating with till software providers to develop a manual button for emergency use will ensure all transactions are accurately recorded. Training staff on the use of standalone card devices and the manual entry process will minimize errors and ensure smooth operation during outages.

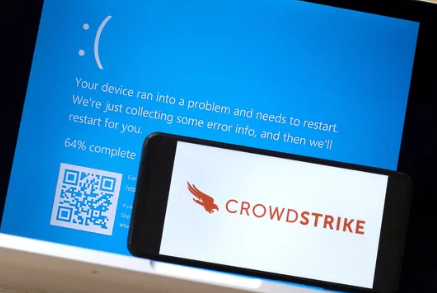

The CrowdStrike Outage

The recent CrowdStrike incident, which crippled businesses worldwide, served as a stark reminder of the vulnerabilities inherent in our digital infrastructure. While integrated card terminals remain the gold standard for efficient point-of-sale transactions, their reliance on the underlying operating system (in this case, Windows) exposes them to risks originating from software failures or cyberattacks.

When CrowdStrike’s security software malfunctioned, it triggered a cascading effect, causing Windows-based point-of-sale systems to crash, effectively disabling integrated card terminals. This disruption underscores the need for robust backup solutions that can operate independently of compromised infrastructure.

GPRS card devices, utilizing cellular networks for communication, emerge as a viable alternative in such scenarios. By bypassing the compromised network infrastructure, these standalone devices can maintain card payment functionality, even allowing for chip-and-PIN transactions without the need for manual entry.

Benefits of Standalone 4G/5G Card Devices

1. Independent Network Connectivity: Standalone 4G/5G card devices operate on cellular networks, independent of the store’s primary internet connection. This means that even if the main network goes down due to an outage like the recent CrowdStrike incident, these devices can continue processing transactions, ensuring uninterrupted service.

2. Enhanced Customer Satisfaction: During network outages, the inability to process card payments can lead to frustrated customers and potential loss of business. With standalone card devices, retailers can continue accepting card payments, maintaining customer satisfaction and loyalty. This is crucial in retaining customers who might otherwise turn to competitors.

3. Quick and Easy Deployment: These devices are relatively easy to set up and deploy across multiple locations. They require minimal integration with existing systems, allowing supermarkets to implement them swiftly without significant operational disruptions.

4. Flexibility and Portability: 4G/5G card devices are portable and can be used in various locations within the store, offering flexibility in managing checkout lines and reducing customer wait times during peak hours or network issues.

Potential Challenges and Considerations

1. Transaction Authorization Process: Even with standalone devices, the transaction authorization process involves multiple steps, including card validation, communication with the payment processor, and approval from the card issuer. If any part of this chain is disrupted, the device alone cannot complete the transaction. Ensuring that cellular networks are robust and have minimal downtime is essential.

2. Manual Entry and Reconciliation: Standalone devices typically do not integrate directly with the store’s point-of-sale (POS) system. This means that cashiers must manually enter transaction details into the primary system for reconciliation and reporting. While this introduces the risk of human error, the alternative—complete inability to process card payments—is far less desirable. Training staff to handle manual entries accurately can mitigate this risk.

3. Cost Implications: Deploying standalone 4G/5G devices involves initial investment costs and ongoing cellular service fees. Supermarkets must weigh these costs against the potential revenue loss and customer dissatisfaction caused by network outages. In many cases, the investment in backup systems will prove to be cost-effective in the long run.

4. Security Concerns: Ensuring the security of transactions processed through standalone devices is paramount. These devices must comply with industry standards and be regularly updated to protect against potential vulnerabilities. Working closely with device manufacturers and network providers to maintain high security standards is essential.

Limitations

If the CrowdStrike outage affected the acquirer’s systems, GPRS devices would likely still be able to read card data and establish a connection with the payment processor. However, the transaction authorization and processing would be disrupted due to the issues on the acquirer’s end. This means that even though the customer’s card is valid and the GPRS device is functioning correctly, the transaction might not go through, or it might be delayed until the acquirer’s systems are back online.

In essence, the GPRS device acts as a bridge between the card and the payment processor, but the actual authorization and settlement of the transaction depend on the acquirer’s infrastructure. If that infrastructure is compromised, the GPRS device cannot fully complete the transaction process.

Thoughts

The recent CrowdStrike-induced outage serves as a wake-up call for retailers to bolster their payment infrastructure. Standalone 4G/5G SIM card-based card devices offer a viable solution to ensure continuous card payment capabilities during network disruptions. While there are challenges associated with their deployment, the benefits of maintaining customer satisfaction and preventing revenue loss make them a worthy investment.

Retailers should consult with their relationship managers to discuss the immediate deployment of these devices and collaborate with till software providers to create manual entry on till processes for accurate transaction recording. By taking these proactive steps, supermarkets can better prepare for future outages, ensuring a seamless and reliable shopping experience for their customers.

Retailers must act now to implement these solutions, ensuring they are prepared for any future outages and maintaining seamless payment operations for their customers.

Ensure your firm is ready for the next outage. Consult with your relationship manager and deploy 4G/5G SIM card-based standalone card devices to maintain seamless payment operations. Don’t let a network failure disrupt your business—act now to protect your customers and your revenue.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any retailer or related entity. The proposed solutions are based on current technological capabilities and industry practices; implementation results may vary based on specific circumstances and infrastructure. Readers are advised to consult with relevant experts and conduct thorough assessments before making any operational changes. Information in this article has been sourced from various news outlets, including TechCrunch and other reputable sources.