Adyen, the Amsterdam-based payments company, reported its financial results for the first half of 2024, showing solid growth across key metrics amid ongoing global economic challenges. The company’s net revenue increased by 24% year-on-year to €913.4 million, supported by the expansion of its omnichannel commerce offerings and continued market penetration.

In its latest communication to shareholders, Adyen reaffirmed its commitment to the long-term strategy outlined during its 2023 Investor Day, emphasizing the importance of disciplined growth and strategic investments. The company highlighted its focus on expanding its global footprint while maintaining a strong emphasis on operating leverage and financial discipline. Adyen’s approach, rooted in customer growth and innovation, remains consistent as it continues to build its platform capabilities, particularly in high-potential regions such as Latin America and Asia-Pacific.

The company also noted that its strategy of retaining end-to-end control over its platform, rather than relying on third-party services, is central to its ability to deliver reliable and scalable solutions. This methodical approach has enabled Adyen to secure new licenses and expand its market share across multiple regions, demonstrating the company’s readiness to capitalize on emerging opportunities while maintaining its core principle of long-term, sustainable growth.

https://investors.adyen.com/events/h1-2024-earnings-call – EARNINGS VIDEO CALL

Financial Performance Highlights (HERE)

Net Revenue: Adyen recorded a net revenue of €913.4 million for H1 2024, a 24% rise compared to the same period last year.

Processed Volume: The company processed €619.5 billion in payment volume, a 45% increase year-on-year, reflecting its expanding role in the global payments market.

EBITDA: Earnings before interest, taxes, depreciation, and amortization (EBITDA) grew by 32% to €423.1 million, with the EBITDA margin improving to 46%, up from 43% in H1 2023.

Free Cash Flow Conversion: The free cash flow conversion ratio remained strong at 85%, with capital expenditures (CapEx) reduced to 4.6% of net revenue, down from 7.6% in the previous year.

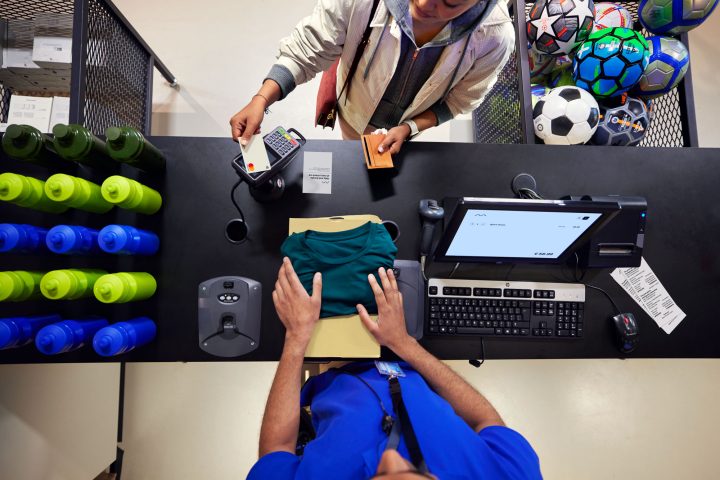

Omnichannel Commerce Growth

Adyen’s growth was notably supported by its Unified Commerce platform, which integrates various payment channels into a single system. This platform saw a 29% year-on-year increase in transaction volumes, with point-of-sale (POS) volumes rising by 32%. These transactions now represent 15% of Adyen’s total processed volumes.

The hospitality sector within Unified Commerce experienced a 55% growth compared to the previous year. The number of Unified Commerce customers increased to 540, up by 79 from the prior year, with the number of active terminals reaching 292,000, an increase of 60,000 units.

A unified payment platform is an integrated system that allows businesses to manage multiple payment methods and channels—such as in-store, online, and mobile payments—through a single platform. This setup streamlines payment processing, enhances the customer experience, and provides businesses with comprehensive data insights across all their transactions, regardless of the payment method or channel used. By consolidating payment processes, a unified platform reduces complexity and operational costs while improving efficiency and scalability for businesses.

Market Expansion

Adyen continued to expand its presence in key global markets, with North America showing the fastest growth at 30% year-on-year in net revenue. This was followed by Europe, the Middle East, and Africa (EMEA) with a 25% increase, and the Asia-Pacific region with a 15% rise.

The company also increased the number of platform customers processing over €1 billion annually by seven, bringing the total to 22. This growth aligns with Adyen’s strategy to strengthen its position in mature and emerging markets.

Future Outlook

Adyen faces challenges from a tightening global economy and changes in consumer spending patterns. The company has maintained its 2024 and 2026 guidance, and its slower hiring pace, with 37 new employees in H1 2024 compared to 551 in the same period last year, has contributed to improved operating leverage.

Adyen’s leadership emphasized the continued relevance of Unified Commerce across various industries, including retail, digital content, and subscription services, as a key factor in its ongoing growth strategy. They say that the more business they do and the more they expand the more value they can bring to their customers.

Market Reaction

Following the release of the H1 results, Adyen’s shares rose by 12% in intraday trading. The company’s financial performance and strategic market expansions have positioned it among Europe’s leading financial firms, with a market value of nearly €40 billion.

Disclaimer: The information provided in this document is for informational purposes only and should not be construed as legal, financial or investment advice. Past performance is not indicative of future results. Please consult with a financial advisor before making any investment decisions.